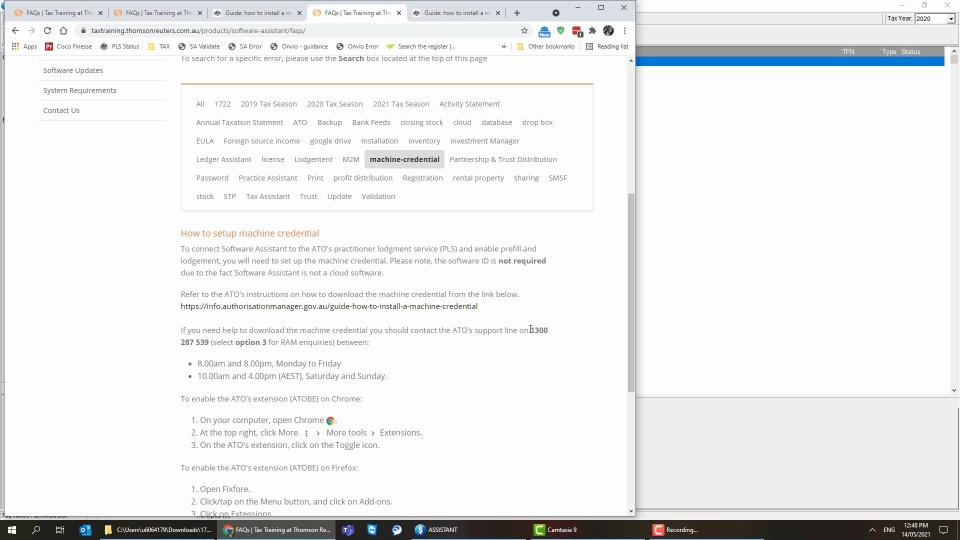

How do I get returns to show in the lodgment queue after setting the return status to ‘signed’.

If you have set the return status to signed and it is still not showing up when you click on the PLS button, then the agent reference number in the Options form does not match the agent number in the tax return, or it is missing. Software Assistant will only include tax returns in the lodgment process if their agent reference number matches the one entered in the User section of Software Assistant’s Options.

- Open Software Assistant’s Options

- Click on the User tab

- Make sure the agent reference number matches the one in the return.